By request, here is another update of an earlier post through the October 2016 employment report including all revisions.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

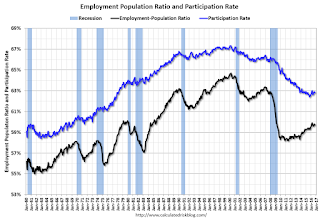

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term |

Private Sector

Jobs Added (000s) |

| Carter |

9,041 |

| Reagan 1 |

5,360 |

| Reagan 2 |

9,357 |

| GHW Bush |

1,510 |

| Clinton 1 |

10,884 |

| Clinton 2 |

10,082 |

| GW Bush 1 |

-811 |

| GW Bush 2 |

415 |

| Obama 1 |

1,921 |

| Obama 2 |

9,3221 |

| 145 months into 2nd term: 9,943 pace. |

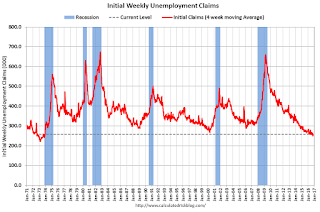

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term, and President Obama is in the final months of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,921,000 more private sector jobs at the end of Mr. Obama's first term. Forty five months into Mr. Obama's second term, there are now 11,243,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 344,000 jobs). This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term |

Public Sector

Jobs Added (000s) |

| Carter |

1,304 |

| Reagan 1 |

-24 |

| Reagan 2 |

1,438 |

| GHW Bush |

1,127 |

| Clinton 1 |

692 |

| Clinton 2 |

1,242 |

| GW Bush 1 |

900 |

| GW Bush 2 |

844 |

| Obama 1 |

-708 |

| Obama 2 |

3641 |

| 145 months into 2nd term, 388 pace |

Looking forward, I expect the economy to continue to expand through the remainder of Mr. Obama's presidency, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are over. Right now I'm expecting some further increase in public employment during the last few months of Obama's 2nd term, but obviously nothing like what happened during Reagan's second term.

Below is a table of the top four presidential terms for private job creation (they also happen to be the four best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 3rd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fifth best for total job creation.

Note: Only 364 thousand public sector jobs have been added during the forty five months of Obama's 2nd term (following a record loss of 708 thousand public sector jobs during Obama's 1st term). This is about 25% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) |

| Rank |

Term |

Private |

Public |

Total Non-Farm |

| 1 |

Clinton 1 |

10,884 |

692 |

11,576 |

| 2 |

Clinton 2 |

10,082 |

1,242 |

11,312 |

| 3 |

Reagan 2 |

9,357 |

1,438 |

10,795 |

| 4 |

Carter |

9,041 |

1,304 |

10,345 |

| 5 |

Obama 21 |

9,322 |

364 |

9,686 |

| |

Pace2 |

9,943 |

388 |

10,332 |

145 Months into 2nd Term

2Current Pace for Obama's 2nd Term |

The last table shows the jobs needed per month for Obama's 2nd term to be in the top four presidential terms. Right now it looks like Obama's 2nd term will be the 3rd best for private employment (behind Clinton's two terms, and ahead of Reagan) and probably 4th or 5th for total employment.

Average Jobs needed per month (000s)

for remainder of Obama's 2nd Term |

| to Rank |

Private |

Total |

| #1 |

521 |

630 |

| #2 |

253 |

546 |

| #3 |

12 |

370 |

| #4 |

-94 |

220 |

from

http://feedproxy.google.com/~r/CalculatedRisk/~3/xvCQ4rxCthM/public-and-private-sector-payroll-jobs.html