Mortgage applications decreased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 21, 2016. The prior week’s results included an adjustment for the Columbus Day holiday.

... The Refinance Index decreased 2 percent from the previous week to its lowest level since June 2016. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier to its lowest level since January 2016. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 9 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.71 percent from 3.73 percent, with points increasing to 0.37 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

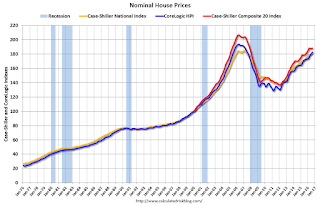

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity increased this year since rates declined, however, since rates are up a little recently, refinance activity has declined a little.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index.The purchase index was "9 percent higher than the same week one year ago".

from

http://feedproxy.google.com/~r/CalculatedRisk/~3/O6lF0okQ4PE/mba-mortgage-applications-decrease-in_26.html