In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) decreased at a 6.2% annual rate in Q3. Equipment investment decreased at a 2.7% annual rate, and investment in non-residential structures increased at a 5.4% annual rate.

On a 3 quarter trailing average basis, RI (red) is unchanged, equipment (green) is slightly negative, and nonresidential structures (blue) is slightly positive.

I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to pick up going forward, and for the economy to grow at a steady pace.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has generally been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

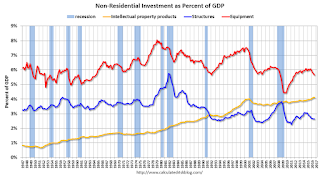

The third graph shows non-residential investment in structures, equipment and "intellectual property products". Investment in equipment - as a percent of GDP - has declined a little recently.. Investment in nonresidential structures - as a percent of GDP - had been moving down due to less investment in energy and power, and is now moving sideways.

The third graph shows non-residential investment in structures, equipment and "intellectual property products". Investment in equipment - as a percent of GDP - has declined a little recently.. Investment in nonresidential structures - as a percent of GDP - had been moving down due to less investment in energy and power, and is now moving sideways.Still no worries - residential investment will pickup (still very low), and non-residential will also pickup.

from

http://feedproxy.google.com/~r/CalculatedRisk/~3/7wQx_lLZwcI/q3-gdp-investment.html

No comments:

Post a Comment