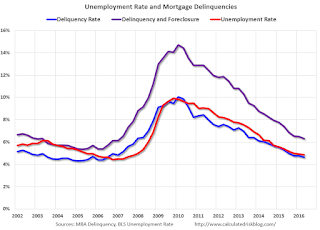

"The mortgage delinquency rate tracks closely with the nation's improving unemployment rate. In the second quarter of 2016, the mortgage delinquency rate was 4.66 percent, while the unemployment rate was 4.87 percent. By comparison, at its peak in the first quarter of 2010, the delinquency rate was 10.06 percent and the unemployment rate stood at 9.83 percent."Here is a graph comparing the mortgage delinquency rate and the unemployment rate. The unemployment rate is in Red, the mortgage delinquency rate (excluding in foreclosure) is in Blue, and the combined delinquency and in foreclosure is in Purple.

Click on graph for larger image.

Click on graph for larger image.As Ms. Walsh noted, the delinquency rate has pretty much tracked the unemployment rate since the great recession.

In 2002, the mortgage delinquency rate was below the unemployment rate, probably because house prices were rising even as the unemployment rate was still recovering from the 2001 recession.

A huge difference between the great recession and prior periods was the large number of homes in the foreclosure process (Purple is a combination of the mortgage delinquency rate and the percent of homes in foreclosure).

The combined rate of delinquencies and in foreclosure is now below the combined rate in 2002. The mix is different (more in the foreclosure process now). These rates are getting close to normal (foreclosures are still elevated).

from

http://feedproxy.google.com/~r/CalculatedRisk/~3/rtD1Iq1ZwlI/mortgage-delinquencies-and-unemployment.html

No comments:

Post a Comment